New Note Category Customs/ Quarantine Note

We have introduced a new note category to Communicater (CTR) called Customs/Quarantine Note. Customs note is now available from your shipment screen and can be accessed from the same area you currently go to for Shipment Note or Transport Note.

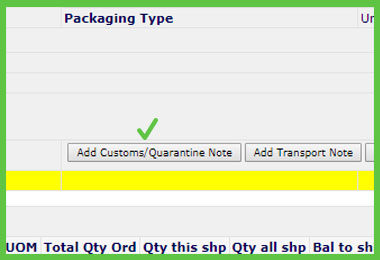

Our customs team will now commence using customs note for all matters that relate to Australian Customs & quarantine matters for clearance of your shipment. Please use the yellow post-it to reply to these notes so your message goes straight to our customs team. Just like with other note categories, you can also add a new customs note by clicking on this button from your shipment page.

So we now have 4 note categories:

1) PO Note, found in your purchase order screen, use this to tell us information about your order before it becomes a confirmed shipment.

2) Shipment Note, found on your shipment screen. Use this note to tell us any information once your order has become a confirmed shipment while in transit. Or for all shipping matters on your export shipment.

3) Transport Note, found on your shipment screen. Use this note to tell us any information about your delivery (if import) or pickup (if export)

4) Customs Note/Quarantine Note, found on your shipment screen. Use this note to tell us any information about customs & quarantine matters for your imports shipments.

You can use the post-it reply method when you reply to our message, which makes it automatically the same note category that we sent you. You can also start a fresh note in any category. All notes are logged in CTR for your future reference showing who sent and who received the note.

All notes are automatically distributed inside GPSM to the correct people.

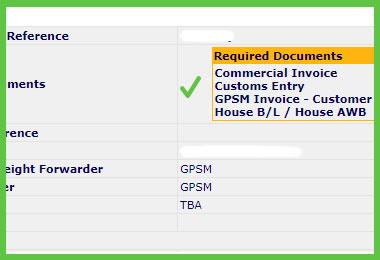

New Document Required Box

If you look at the top right-hand side of your screen  you will now see a Documents Required Box, Inside this box you will find listed the key documents required for your shipment. As we receive the copies of documents from you and other sources we will add them to your Doc Pack, at that time they will be removed from this new Document Required Box. (This feature only relates to us receiving copy documents, if originals are required current systems still apply)

you will now see a Documents Required Box, Inside this box you will find listed the key documents required for your shipment. As we receive the copies of documents from you and other sources we will add them to your Doc Pack, at that time they will be removed from this new Document Required Box. (This feature only relates to us receiving copy documents, if originals are required current systems still apply)

Regarding Original Bill of Lading, the same system as currently applies remains unchanged. That is noted on your shipment.

New FTA flag in your shipment

We have added a new checkbox to better manage when an FTA applies. This box appears above your BOL Status box. If your shipment has an origin country where there is an FTA in place with Australia, this box will be visible  on your shipment. Initially, it will show “May be Required†what this is saying is that there is FTA in place with origin country, but as yet we have not assessed the commercial invoice to determine if the goods are dutiable. If the goods are duty-free in their own right, FTA is not required as no commercial advantage. We will select the updated option once we have assessed the commercial invoice and then you will see either:

on your shipment. Initially, it will show “May be Required†what this is saying is that there is FTA in place with origin country, but as yet we have not assessed the commercial invoice to determine if the goods are dutiable. If the goods are duty-free in their own right, FTA is not required as no commercial advantage. We will select the updated option once we have assessed the commercial invoice and then you will see either:

Is required in order to obtain reduced duty

Is not required as good are duty-free in their own right

As always FTA is optional, if not supplied it may effect duty payable. If it’s supplied after delivery and duty were paid, a refund of duty may be possible, processing fees apply.

We hope you enjoy this new feature and as always let us know if you have any questions or comments.