GPSM has created a new method to process document packs (Doc Pack) on Communicater (CTR). Up until now, your doc pack appears on CTR around the time of delivery. It is a scanned full set of commercial documents added as one file. An email alert is sent to the subscribed parties to let them know a new doc pack is available.

Superseding this system is our new doc pack, the new doc pack will open when we receive the first document from any source. You will find it located next to the original doc pack icon. The new document pack will close when the last document is entered and at that time subscribed parties will receive an email alert to notify it is complete.

Advantages of the new doc pack system:

1. There is now one central place for you to find documents, in the new doc pack, any document we have on hand will be immediately stored there for your use, no need to scroll through the notes looking for documents.

2. The last documents to be added will be the GPSM invoice and customs entry, they will now be added to the doc pack immediately after we complete the invoicing, so no more delay between when we complete invoicing and when a doc pack is available.

3. Your GPSM electronic POD is now part of the doc pack. It will still also be accessible from the notes are of CTR.

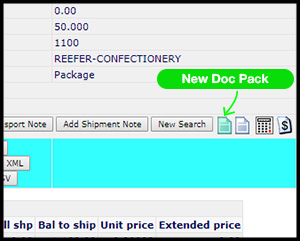

4. To identify what doc pack type you are looking at, the white symbol is the original doc pack. The green symbol is the new doc pack. You can also hover over a doc pack, it will say either “Old Customer Doc Pack†if the older format and will say “Customer Doc Pack “ if new format.

the original doc pack. The green symbol is the new doc pack. You can also hover over a doc pack, it will say either “Old Customer Doc Pack†if the older format and will say “Customer Doc Pack “ if new format.

5. During the transition period of around 4 weeks, you will see 2 document packs appearing after the older format one is added. Once we have fully transitioned you will only see the new document pack format.

6. All older style doc packs will still be stored on CTR for you to access as needed.

7. You will find some of the documents are clearer, as many are no longer scanned, they are added to CTR from the document source.

8. It’s easier to print a certain page or pages from the total selection with the new format.

We hope you enjoy this new initiative we are delivering to our customers.

Your feedback, comments and questions as always are most welcome!