Ongoing Industrial Action at DP World Terminals:

Following is the updated advice received from Nicolaj Noes (DP World Australia Executive Vice President – Oceania) on the current status at DP World terminals, with industrial action continuing until 30 October, 2023:

Dear Customers,

I write to provide an important update on the current protected industrial action being undertaken by the CFMMEU-MUA DIVISION and its impact on our operations.

Since the inception of the bans by the CFMMEU-MUA DIVISON on 6th October 2023, there have been tangible disruptions across all our terminals. Exporters, importers, and the broader supply chain have felt the ripple effects of these disruptions, particularly in berthing arrangements and landside services, including road and rail operations.

However, we are fully committed to seeking efficient alternatives at DP World. We aim to ensure vessels are serviced proficiently, upholding our scheduling commitments.

Over the last six months of Enterprise Bargaining, we’ve approached negotiations in the spirit of collaboration and good faith. Our stance has been flexible, making concessions where they align with the broader interests of our business, our customers, and the Australian community. However, the CFMMEU-MUA DIVISON’s current stance has posed challenges. Recent discussions held in September 2023 brought limited progress. While we had scheduled further meetings for 17-19 October 2023, their continuation is contingent on the cessation of protected industrial actions, a condition the Union has not yet agreed to.

Our priority remains clear: serving the Australian public and ensuring service disruptions are kept to a minimum. In the spirit of transparency and community interest, we implore the CFMMEU-MUA DIVISION to engage in constructive dialogue. While we recognise the right of the CFMMEU-MUA DIVISION to take industrial action, its repercussions are felt by our hardworking employees and the wider Australian community.

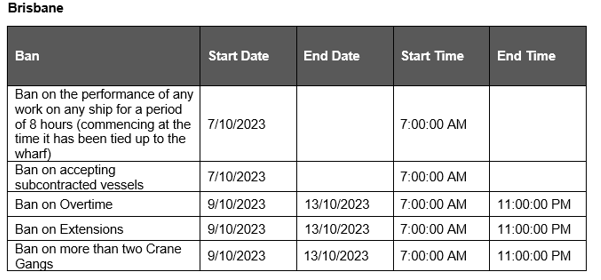

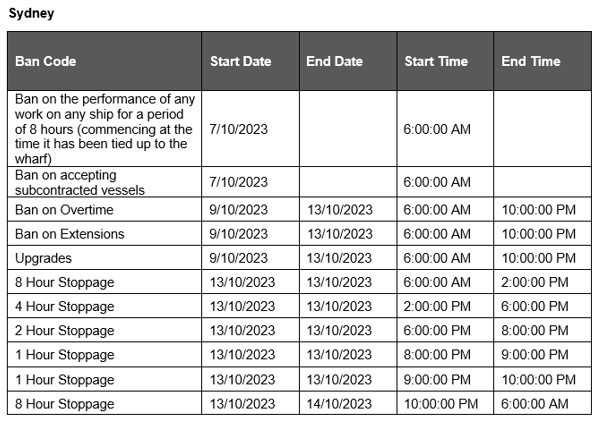

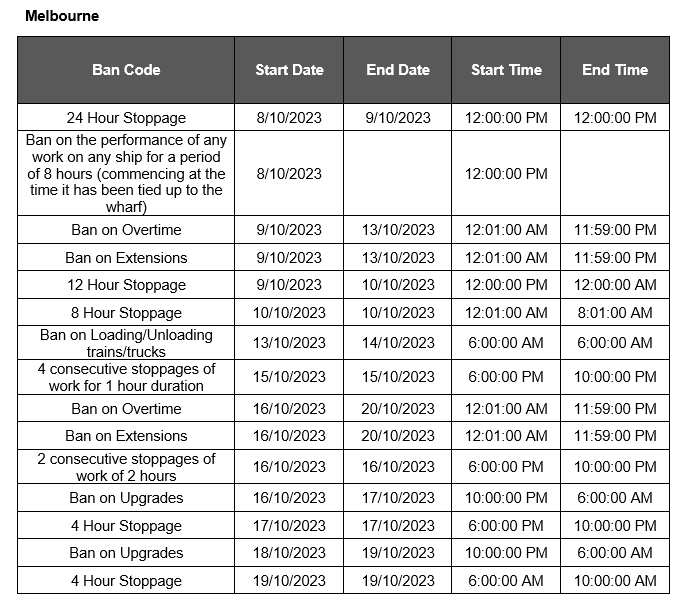

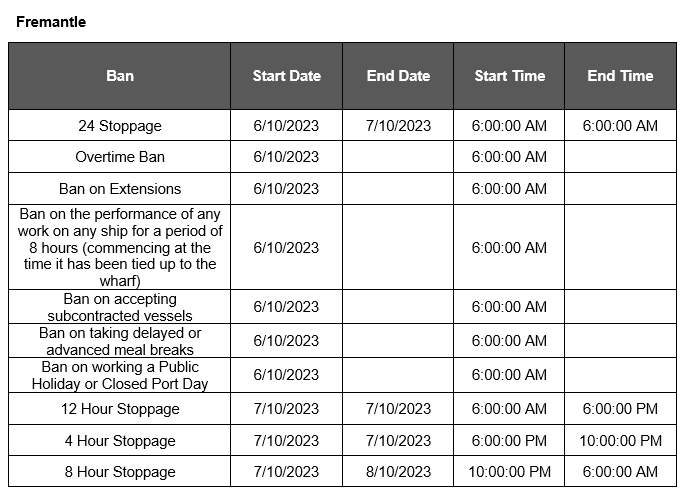

In compliance with Section 414(2)(b) of the Fair Work Act 2009 (Cth), please be informed of the forthcoming protected industrial actions by members of the CFMMEU covered under the DP World Enterprise Agreements. These actions aim to advocate for claims concerning a proposed Enterprise Agreement.

For specific concerns:

- Shipping lines and further clarification: [email protected]

- Sales-related concerns: [email protected]

Your understanding and patience during this period are greatly appreciated. Our commitment is unwavering, and we will continue to work towards ensuring seamless services for all our esteemed clients.

Warm regards,

Nicolaj Noes

Executive Vice President, Oceania

DP World Australia

Freight & Trade Alliance (FTA) and the Australian Peak Shippers Association (APSA) once again urges all parties involved in the industrial dispute to work together on a quick resolution to minimize the impact on workers, freight and the nation.

GPSM Transport Team are constantly monitoring the situation in all states and will be in contact with customers that are affected by this industrial action.