Many clients will be aware of the struggle to find space on the USA to Australia/New Zealand trade at present .

Recent weather events including a heavy snow storm that has swept across the country from the Gulf all the way to the north east corner of USA has hampered pick-ups and deliveries of FCL and LCL shipments since late last week.

Not only have many of the USA East Coast ports and rail systems have been affected by snow drifts and huge traffic delays, a large number of truckers have had to close as well.

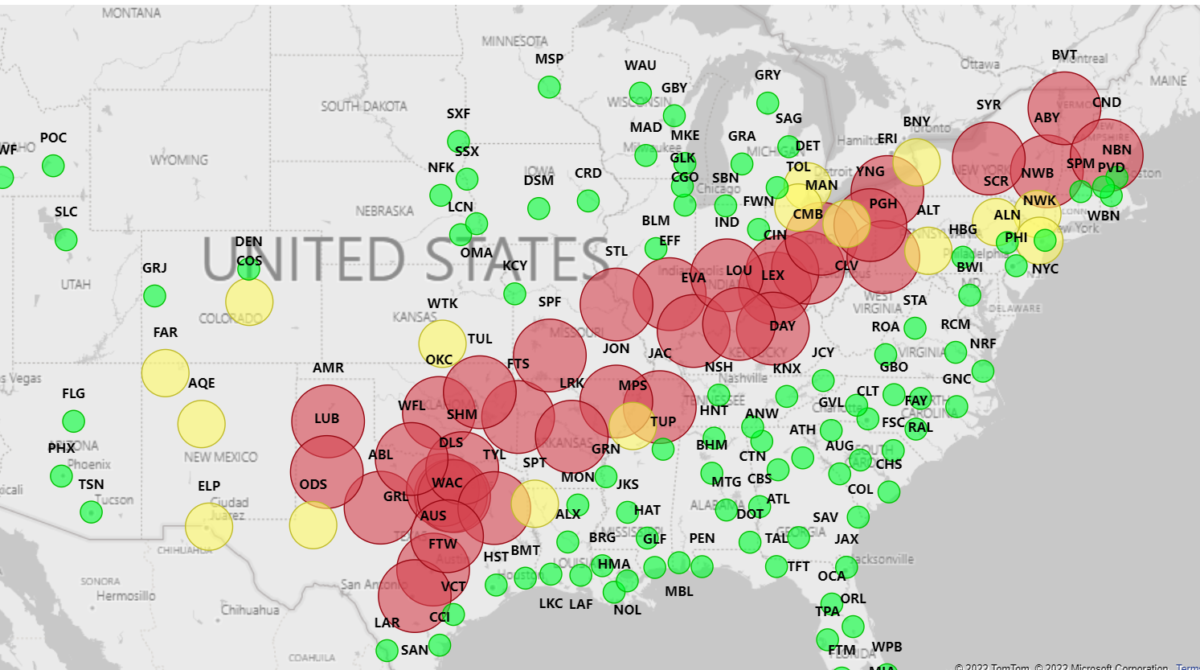

Below is a map showing the trucking terminal closures (the red and yellow dots) as a result of icy and snow affected roads being unsafe to drive on. This adds to the existing issues of equipment and driver shortages throughout the industry.

FCL bookings are extremely difficult to obtain since Maersk Line changed their direct service to a transshipment service over Asia.

Masrk were vessel sharing with their associated company Hamburg-SUD on a weekly basis so effectively the USA-ANZ direct services has lost capacity of some 12,000-14000 container slots per week.

The remaining direct carriers, CMA, MSC and Hapag-Lloyd are all overbooked and bookings are now being put out to 6-8 weeks delay as a result of the shortage of space and the continuing unprecented volume of containers moving on the trade lane.

The other transshipment carrers to ANZ over Asia, including YML, Evergreen, COSCO and OOCL are seeing huge volumes still existing on that service despite the closure of factories in Asia for Chinese New Year, however we are now seeing a trickle of bookings to ANZ now being offered by these carriers since they shut down all bookings to ANZ prior to Xmas 2021.