Patrick Terminals has received notifications for industrial action at our Patrick Terminals – Melbourne and Patrick Terminals – Sydney AutoStrad. These notifications are listed below in bold .

After weeks of significant labour availability due to the impact of COVID-19 cases in Melbourne, the MUA has now taken to issue the Melbourne terminal with two weeks of continuous rolling stoppages and work bans for the first two weeks of November that will significantly impact the ability of the terminal to recover.

The MUA continues to launch further damaging industrial action despite ongoing discussions occurring with the National office on a near-daily basis in an attempt to finalise the Enterprise Agreement.

Michael Jovicic, CEO Patrick Terminals said, “We have requested on multiple occasions that the MUA bargain without continuing their economically damaging industrial action.

“Now issuing 19 new industrial notifications of rolling 12-hour strike actions every Monday, Wednesday and Friday in the coming fortnight at our already struggling Melbourne terminal is frankly bewildering. Our terminal is still working to recover from reduced labour availability due to recent COVID-19 cases and this industrial action will result in significant delays.

“Plus we now have a 24-hour stoppage in Sydney on Melbourne Cup Day.

“We call on the MUA once again to accept the generous offer on the table and move forward with just getting back to work.”

Terminal Operations Update

Patrick Terminals – Sydney AutoStrad

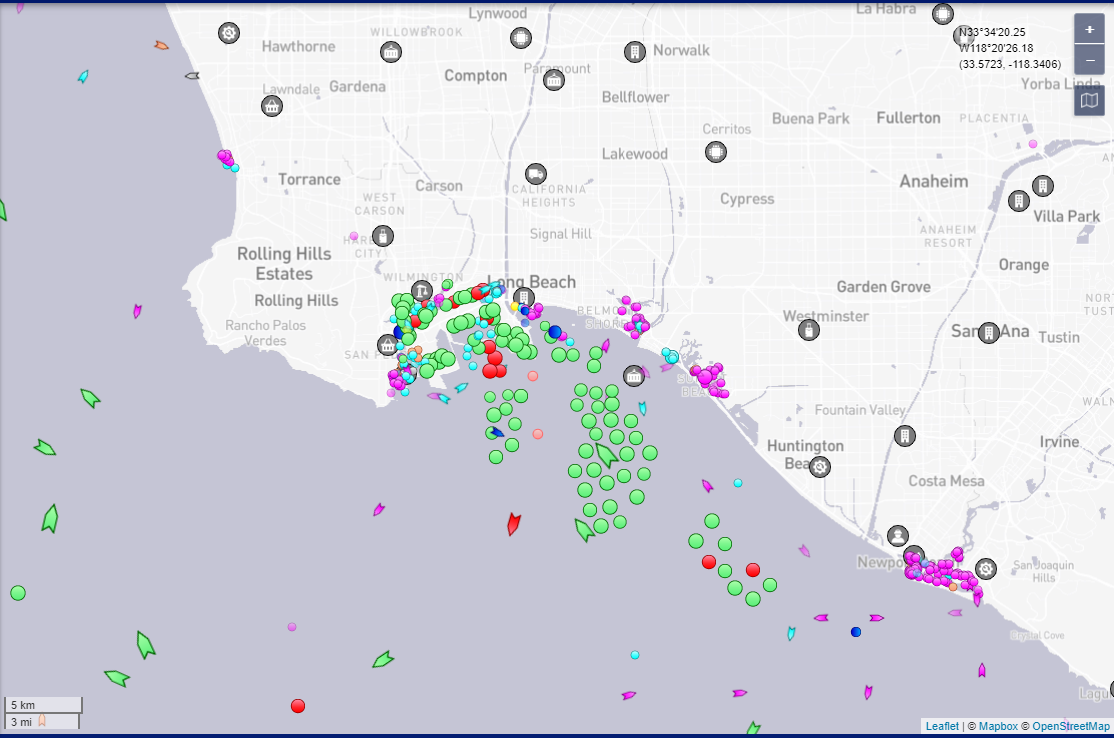

- The current delays at the Sydney terminal are on average 1 day and are forecast to increase with the current and notified industrial action for Melbourne Cup Day.

Patrick Terminals – Brisbane AutoStrad

- The current delays at the Brisbane terminal are up to 5 days and are forecast to increase with the current industrial action.

Patrick Terminals – Fremantle AutoStrad

- The terminal is being impacted by industrial action with vessel delays now averaging 8.5 days.

Patrick Terminals – Melbourne AutoStrad

- The terminal is presently operating with a 4 days delay due to reduced labour availability resulting from COVID cases and close contact isolation requirements. Delays are forecast to increase with notified industrial action.

Patrick Terminals continues to work with customers to minimize the impact of this industrial action by the MUA. Our focus continues to be on supporting the Australian supply chain with an efficient and effective service that supports Australia’s economic recovery.

Please reach out to your Client Services Manager if you would like any further details.

Regards,

Patrick Terminals