A reminder The Australian Border force is actively selecting goods for testing , please read the attached information If your goods are impacted.

Asbestos

An Australia-wide ban on the use of all types of asbestos took effect on 31 December 2003. Work Health and Safety (WHS) and environment laws in all States and Territories prohibit the unauthorized supply, transport, use (including manufacturing), or handling of asbestos.

To support the domestic ban:

- Importing asbestos or goods containing asbestos into Australia is prohibited, unless a permission has been granted or a lawful exception applies, under Regulation 4C of the Customs (Prohibited Imports) Regulations 1956.

- Exporting asbestos or certain goods containing asbestos from Australia is prohibited, unless a permission has been granted or a lawful exception applies, under Regulation 4, and Schedule 1, of the Customs (Prohibited Exports) Regulations 1958.

Australia is one of the few countries in the Asia/Pacific region that has a comprehensive ban on all six types of asbestos. In many countries, despite the known threat to human health, local standards allow low levels of particular types of asbestos to be used for manufacturing. Goods manufactured outside Australia might be labelled “asbestos free” and still contain low levels of asbestos. Such goods will not be permitted for import into Australia, except in very limited circumstances.

The border control for asbestos is not enforced with consideration of the level of risk to the end-user of the goods. Importers must not base their judgement on a perceived low risk, as any risk of asbestos content must be addressed before shipment to Australia.

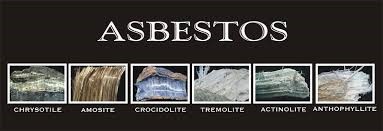

Types of prohibited asbestos

The border control for asbestos extends to the importation and exportation of asbestiform varieties of mineral silicates belonging to the serpentine or amphibole groups of rock forming minerals including the following:

- actinolite asbestos

- grunerite (or amosite) asbestos (brown)

- anthophyllite asbestos

- chrysotile asbestos (white)

- crocidolite asbestos (blue)

- tremolite asbestos

- a mixture that contains one or more of the minerals referred to above

Goods that might contain asbestos

Asbestos has been used in a wide number of products due to its flexibility, tensile strength, insulation, chemical inertness and affordability and is still used outside Australia in many applications.

The following goods are considered a risk for containing asbestos:

- Asbestos bitumen products used to damp proof

- Asbestos rope

- Asbestos tape

- Brake linings or blocks

- Cement flat sheeting or panels

- Cement pipes, tubes or fittings

- Cement shingles or tiles (external or ceiling)

- Clutch linings or brake disc pads

- Crayons

- Diaphragms

- Ducts

- Electrical cloth and tapes

- Electrical panel partitioning

- Fire blankets

- Fire curtains

- Fire resistant building materials

- Friction materials for, or within, internal combustion and electric motor vehicles (for example, clutch linings, brake pads and shoes and gaskets)

- Furnaces

- Gas masks

- Gaskets or seals

- Gloves

- Heat resistant sealing or caulking compounds

- Heating equipment

- Lagging and jointing materials

- Mastics, sealants, putties or adhesives

- Mineral samples for display or therapeutic purposes

- Mixtures containing phenol formaldehyde resin or cresylic formaldehyde resin

- Nut Plug products used for drilling fluids

- Pipe spools

- Portable acetylene cylinders

- Products containing certain types of talc

- Raw materials from mining activities

- Sheet vinyl backing

- Sheeting

- Textured paints or coatings

- Tiles

- Yarn and thread, cords and string, whether or not plaited

Countries from which goods containing asbestos have been detected

Below is the list of countries from which goods containing asbestos has been detected:

- China

- Germany

- Indonesia

- Italy

- Japan

- New Zealand

- Singapore

- South Africa

- Taiwan

- The Netherlands

- United Kingdom

- United States of America

- Vietnam

Note: the list represents the country of shipment, not necessarily the country of manufacture. Importers must be aware of their supply chain including the origin and manufacturing process of parts and components, particularly those at risk of containing asbestos.

The above lists are non-exhaustive and subject to change. They are listed in alphabetical order and should be used as a guide only.

The ABF targets goods considered to have a risk of containing asbestos. Any unauthorised goods found to contain asbestos will be seized and the importer may face penalties and/or prosecution.

Ensuring the goods do not contain asbestos

It is the responsibility of importers and exporters to ensure they do not import or export prohibited goods such as asbestos. We must be assured that no asbestos is present at the time of import or export.

There are factors that increase the risk of importing goods that contain asbestos. Definitive enquiries should be made with suppliers outside Australia about any use of asbestos at the point of manufacture, before importing the goods into Australia.

Importers should be aware of the increased risk of goods containing asbestos when sourced from countries that have asbestos producing industries. Goods that are manufactured in the same factory that produce asbestos containing goods are considered a risk due to possible cross contamination.

Importers should not assume that goods labelled “asbestos free†are in fact free of asbestos or that testing of goods undertaken overseas certified “asbestos free†meet Australia’s border requirements. Some countries can lawfully label or test goods, declaring them asbestos free, if they are below a certain threshold.

To ensure that goods which are manufactured overseas do not contain asbestos, importers should question their overseas suppliers about the use of asbestos at any point in the supply chain. Importers are also encouraged to investigate, and where appropriate implement:

- contractual obligations with their suppliers that specify nil asbestos content

- sampling and testing for asbestos content before shipping the goods to Australia

- regular risk assessment and quality assurance processes, that take into account:

- what raw materials are used in the manufacture of the goods

- where manufacturers outside Australia source their raw materials

- identifying and subsequently minimising asbestos-risk activities at the point of manufacture

If the ABF suspects that goods arriving at the border contain asbestos, the goods are detained and examined. Documents that provides sufficient assurance must be provided. The importer may be required to arrange testing and certification by a ‘competent person’ to ensure there is no presence of asbestos. The arrangement and cost of any independent inspection, testing and storage of the goods is the responsibility of the importer/exporter in Australia in line with section 186 of the Customs Act 1901 (the Customs Act). If Australian importers can demonstrate their own supply chain assurance program they could avoid delays to the clearance of their goods at the point of importation.

https://www.abf.gov.au/importing-exporting-and-manufacturing/prohibited-goods/categories/asbestos

Attachments